Today’s post features information that originally appeared in my paid newsletter, The Hot Sheet.

As much of the retail world faces crisis, book publishing is positioned to grow in terms of unit sales when compared to 2019. In fact, 2020 may prove to be one of the strongest sales years in recent memory.

A few factors are likely contributing to the resilience of sales:

- the prevalence of online purchasing in the US market (driven by Amazon, of course)

- the strength of Ingram’s print-on-demand operations in the US—and the overall robustness of the US supply chain thus far

- the current events/bestseller effect, with race relations and politics driving high sales of titles such as White Fragility by Robin DiAngelo, How to Be an Antiracist by Ibram X. Kendi, John Bolton’s The Room Where It Happened, and Mary Trump’s Too Much and Never Enough. (Outperforming titles can bring a book category into a growth position or soften—even turn around—a decline for the market.)

- the high adoption rate of ebooks and audiobooks in the US market prior to the pandemic

- the migration of print sales to big-box retailers, as written about by the New York Times.

Let’s dig deeper into what’s happening.

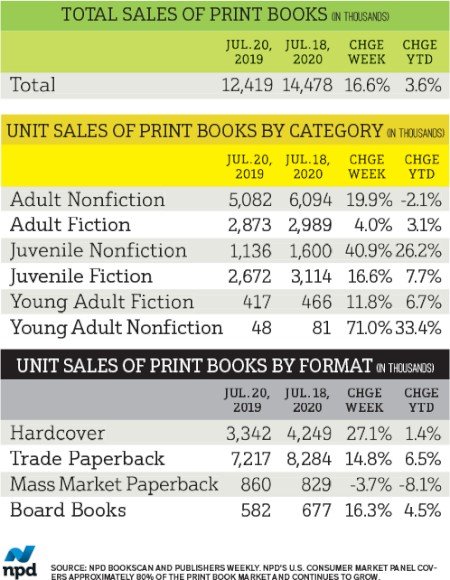

US print unit sales are up by 3.6% so far versus 2019

This data comes from NPD BookScan, which tracks sales through retailers; it’s the best industry measure available for traditional publishing sales. According to their latest report, print sales growth is driven by:

- children’s nonfiction, up by 26% over 2019

- nonfiction books on race relations and social justice

- children’s fiction (excluding YA), up by 7.7%

- YA fiction, up by 6.7%

- adult fiction, up by 3.1%

- graphic novels, up by 10.3%

To find signs of trouble, you have to look at the challenged textbook market (a result of closed schools), a sales category not really captured by NPD BookScan. Other markets, like the UK, are seeing that same decline.

It’s possible that even though unit sales will increase in 2020, dollars may decline. A high volume of sales during the COVID lockdown have been for lower-priced books, such as juvenile nonfiction titles.

In the juvenile sector, the best performing categories include education and reference (of course, due to schooling needs), games and activities (to keep kids occupied and entertained), and other educational categories like history/sports/people/places and biographies. Publishers with nonfiction content in the educational and homeschool space—especially those serving the younger end of the scale—will have a very good year.

US ebook sales are up by 4% versus last year—an excellent result

US traditional publishers report 4.3% growth in ebook sales through May 2020, after years of decline. All of that growth is the result of the pandemic; during the first three months of 2020, NPD showed ebook sales down 18% versus 2019. Publishing Perspectives offers more detail on ebook sales trends, with category-specific information.

Bricks-and-mortar bookstore sales are down

The US Census Bureau publishes preliminary estimates of bookstore sales, and even though print unit sales are up according to NPD BookScan, the government report shows bookstore sales declining by 33 percent in March, 65 percent in April, and 59 percent in May. The most obvious explanation for why book publishing continues to perform well as an industry: print sales have drifted to online channels, such as Amazon or Bookshop, and to big-box stores.

Barnes & Noble CEO James Daunt says that its sales are down about 20 percent overall from last year.

UK print sales aren’t doing as well

UK started the year positive: the first quarter saw 3% growth in unit sales. But that growth started to decline in February, and sales dipped even further once lockdown hit. Right now, the UK market is estimated to be down by 11% versus last year. Interestingly: UK’s online book purchasing in 2020 has modestly increased to 38% from 2019’s 36%. We have to wonder if this has contributed to the UK’s weakness in sales versus the US market—or maybe it’s simply that the US market has a higher rate of online purchasing already, at an estimated 50% of sales.

Audiobook sales grew in 2019, but at a slower pace

According to the Audiobook Publishers Association, audiobook growth slowed considerably in 2019, declining to 16.4 percent dollar growth versus 34.7 percent in 2018. Review more data from the Audio Publishers Association.

Regardless, everyone expects more growth in audio—and it will come from many parts of the world and from multiple formats and business models. Javier Celaya of Dosdoce believes, at current growth rates, audiobook/podcast revenue will surpass ebook revenue by 2023. Although there are twice as many podcast listeners as audiobook listeners, each audiobook listener generates more than 2.4 times the annual revenue of a podcast listener.

Subscription services are growing at a faster rate in Europe and emerging markets. And they are growing faster than audiobook unit sales, still the dominant model in the US (which is perhaps not the happiest trend for big US publishers who have pulled out of subscription services due to profitability concerns). In Sweden, perhaps the most mature market for audiobooks—where subscription service Storytel is based—audio makes up half of all fiction sales.

What might happen next?

According to Kristen McLean at NPD Books, it won’t be demand that determines the industry’s future. Rather, she says it will be driven by:

- The stability of the channels which are currently selling and delivering books. Will stores stay open? Will the supply chain (printers, print-on-demand facilities, other delivery channels) remain resilient?

- The length and depth of the economic crisis which has been unfolding. Will governments help consumers, businesses and others?

- The pre-existing (financial) health of the businesses in the traditional book industry. Do they have the capital and the resources to get through this?

If you enjoyed this post, consider signing up for The Hot Sheet, the essential industry read for authors. You can try the first two issues for free.

Jane Friedman has spent nearly 25 years working in the book publishing industry, with a focus on author education and trend reporting. She is the editor of The Hot Sheet, the essential publishing industry newsletter for authors, and was named Publishing Commentator of the Year by Digital Book World in 2023. Her latest book is The Business of Being a Writer (University of Chicago Press), which received a starred review from Library Journal. In addition to serving on grant panels for the National Endowment for the Arts and the Creative Work Fund, she works with organizations such as The Authors Guild to bring transparency to the business of publishing.

Interesting, Jane. I will take this into account for my next book. Maybe book signing needs to move to Walmart:)

Looking forward to hearing you at HNS 2021

Thank you, Michael!

TFG

“Thank Forking God”; not “Taken For Granted.”

[…] US Book Publishing Remains Resilient: Print and Ebook Sales Are Growing […]

[…] Friedman, J. (2020). U.S. Book Publishing Remains Resilient: Print and Ebook Sales Are Growing. Retrieved from: https://janefriedman.com/us-book-publishing-remains-resilient-print-and-ebook-sales-are-growing/ […]

[…] pricked up hopeful ears … and were subsequently rewarded for their stamina. By 2020 ‒ thanks, in part, to the COVID-19 pandemic ‒ book sales were outstripping figures from the previous year … so too, in fact, were e-reader […]